As the global economy shifts towards sustainability and technological advancement, the scrap metal recycling industry is experiencing notable transformations. Investors and industry stakeholders should focus on specific high-value scrap metals that are projected to be particularly lucrative in 2025.

1. Copper

Copper remains a cornerstone in various industries due to its excellent conductivity and versatility. The surge in renewable energy projects, electric vehicles (EVs), and data centers has significantly increased copper demand. Companies like Glencore are enhancing their recycling capabilities to meet this demand by processing electronic waste and other scrap materials into new copper products. WSJ+1Reuters+1

2. Aluminum

Aluminum’s lightweight and corrosion-resistant properties make it indispensable in the automotive, construction, and packaging sectors. The push for fuel-efficient vehicles and sustainable packaging solutions is driving the demand for recycled aluminum. The Asia Pacific region, particularly China and India, is witnessing substantial growth in aluminum consumption, emphasizing the need for efficient recycling processes. iScrap AppPrecedence Research

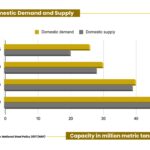

3. Steel

The steel industry is increasingly adopting electric arc furnace (EAF) technology, which utilizes scrap metal to produce new steel with a lower carbon footprint. Facilities like BlueScope’s North Star steelworks in Ohio exemplify this trend, leveraging EAF technology to cater to sectors such as automotive and construction. The Australian

4. Precious Metals from E-Waste

Electronic waste (e-waste) is a growing source of precious metals like gold, silver, platinum, and palladium. The rise in consumer electronics and rapid technological obsolescence contribute to increasing e-waste volumes. Innovative recycling technologies are emerging to efficiently extract these valuable metals, presenting a promising investment opportunity.

5. Nickel and Cobalt

Nickel and cobalt are critical components in battery production for EVs and renewable energy storage systems. Companies like Nth Cycle have developed technologies to extract and refine these metals from scrap, reducing reliance on traditional mining and supporting the clean energy transition. Time

Investment Considerations

Investing in the scrap metal recycling sector requires attention to several factors:

By focusing on these high-value scrap metals and considering the evolving market dynamics, investors can position themselves to capitalize on the opportunities in the recycling industry in 2025 and beyond.

2025-07-21T06:20:27

2025-05-16T08:22:06

2025-04-30T18:46:27

2025-04-19T06:27:16

2025-04-16T16:52:55