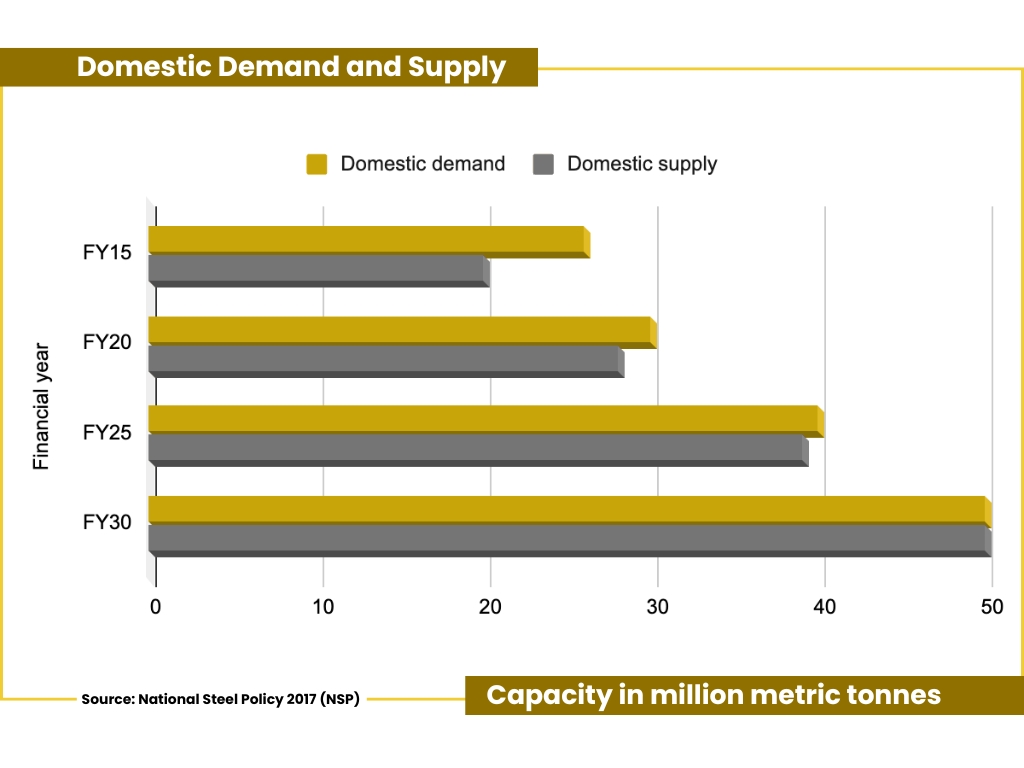

India’s metal recycling industry is growing fast, as the world looks for cleaner and greener ways to make steel. According to India’s National Steel Policy (NSP), the country will need 70 million metric tonnes of scrap metal by 2030, more than double the current amount of 30 million tonnes.

But there are still some big challenges. Poor quality of scrap, weak collection systems, and outdated recycling technology make it hard for India to meet its sustainability goals. As the world sets stricter environmental rules, can India catch up?

Europe is pushing for greener industries with rules like the Carbon Border Adjustment Mechanism (CBAM). If Indian steelmakers don’t reduce their carbon emissions, they could face a $80/tonne tax when exporting to Europe, which is India’s largest steel export market.

To avoid this, Indian companies are now working on low-carbon steelmaking:

According to the NSP, India aims to produce 300 million tonnes of steel by 2030, with 35-40% of it coming from EAFs and Induction Furnaces (IFs), which mainly use recycled steel. That’s around 120 million tonnes of green steel each year.

Scrap metal is also used in other steelmaking processes like Basic Oxygen Furnaces (BOFs), making production more efficient and cheaper. But to grow, the industry needs a steady supply of high-quality scrap at reasonable prices.

The government wants more recycled steel to be used in production:

India doesn’t produce enough scrap locally, so it imports recycled steel. In 2024, India imported 9.49 million tonnes, down from 11.75 million tonnes in 2023, as per customs data.

Even though the industry is growing, there are still many issues:

India’s steel demand is growing fast. It is expected to increase by 9-10% in FY2025. In the April–June 2024 quarter alone, demand grew 15%.

To meet this need, steelmakers are rapidly increasing capacity:

The rise of electric vehicles (EVs) is also helping the recycling sector. EVs need a lot of steel, aluminum, and copper for batteries and motors.

By 2024, India had more than 5.6 million EVs, with 2 million sold in just that year, up from 1.6 million in 2023.

Government programs like FAME are pushing EV use, which increases the need for recycled metals. Using recycled metals saves energy and reduces the need for mining.

Companies are responding:

India’s metal recycling sector is on the rise, thanks to:

But to reach its full potential, investment in technology, better collection systems, and cleaner scrap supply is essential.

With its large steel production target and focus on recycled materials, India is preparing to become a global leader in green steel and metal recycling.

Source: National Steel Policy 2017 (NSP)

The article was first published in the Recycling Today, Spring 2025 Scrap Recycling issue.

2025-07-21T06:20:27

2025-05-16T08:22:06

2025-04-30T18:46:27

2025-04-19T06:27:16

2025-04-16T16:52:55