Image Source: www.bigmint.co

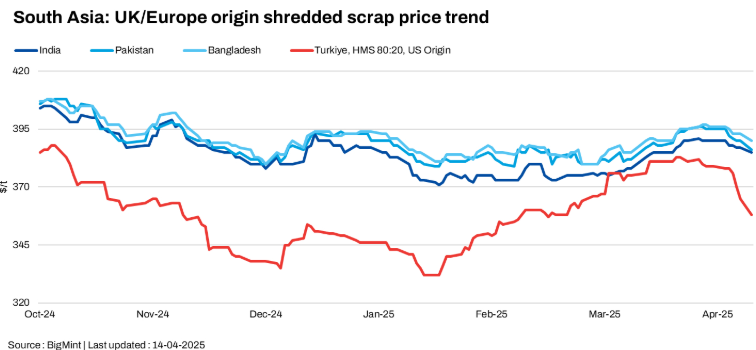

The imported scrap market in South Asia has been going through a mixed phase, with prices dipping slightly in key regions, while Turkiye saw a more noticeable drop.

In South Asia, UK-origin shredded scrap offers fell by up to $4 per tonne over the past few days. Prices dropped by $2/t in India, $3/t in Bangladesh, and $4/t in Pakistan. Meanwhile, Turkiye saw a sharper fall of $7/t for US-origin HMS 80:20 scrap.

India’s scrap market had a mixed tone. Domestic steel prices improved slightly, encouraging some bookings. However, concerns about the weakening rupee and falling global scrap prices, especially from Turkiye, kept many buyers on edge.

The availability of cheaper domestic scrap and direct reduced iron (DRI) further reduced interest in imported materials.

Pakistan’s market remained slow after Eid. Local sales were weak, and global scrap prices didn’t help much. Turkish scrap price drops and cheap Chinese steel offers added pressure.

Most mills are waiting for clearer market signals and the upcoming national budget before making new purchases.

In Bangladesh, activity remained slow due to ongoing issues with opening letters of credit (LCs) and limited foreign exchange. Despite strong remittance and export inflows in March, mills were cautious.

Overall, concerns about inflation, LC restrictions, and political uncertainty kept market sentiment low.

Turkiye saw the biggest drop in imported scrap prices, with US-origin HMS 80:20 falling by $7/t compared to Friday’s close, and a total drop of $25-30/t since early April.

Mills are holding back due to weak rebar sales, uncertainty around tariffs, and high energy costs, making sellers lower their offers even further.

Source: www.bigmint.co

2025-07-21T06:20:27

2025-05-16T08:22:06

2025-04-30T18:46:27

2025-04-19T06:27:16

2025-04-16T16:52:55